I’m trying to fetch the initial 5 min date when the New York market opens at UTC 13:30:00Z.

Considering the time gap, I thought 13:30:00Z will be fine to be 09:30:00Z in New York time.

But the result I’m getting is somewhat so much different from what I’m observing from TradingView.

Of course I understand they are fetching different market data there must be a difference.

But the gap I’m seeing is not simply the gap, but completely wrong trend.

I’m trying to observe if the stock burst up with high volume at the first 5 min.

Alpaca says it is, but it’s so quiet (Hundreds of volume..) which doesn’t make sense.

Am I using the API in a wrong way?

Please correct me if I’m wrong.

Alpaca API call :

curl --request GET \

--url 'https://data.alpaca.markets/v2/stocks/bars?symbols=EXLS&timeframe=5Min&start=2025-09-17T13:30:00Z&end=2025-09-17T13:34:00Z&limit=1000&adjustment=raw&feed=sip&sort=asc' \

{API_KEY_REDACTED}

--header 'accept: application/json'

>>>

{

"bars": {

"EXLS": [

{

"c": 42.755,

"h": 42.78,

"l": 42.245,

"n": 200,

"o": 42.3,

"t": "2025-09-17T13:30:00Z",

"v": 30618,

"vw": 42.392441

}

]

},

"next_page_token": null

}

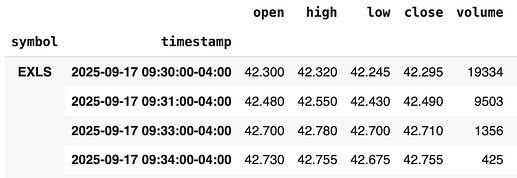

What I’m getting on Trading View :

The volume for the first 5min was 1.21K which is not a burst compared to previous days.